FMCX is an actively managed ETF that seeks to invest in the highest-conviction ideas of First Manhattan's research team.

Through its wholly owned investment adviser subsidiary First Manhattan Co. LLC, First Manhattan is the investment adviser to FMCX. Independently owned and operated, First Manhattan has more than six decades of fundamental, research-based investing experience.

Why Invest in FMCX?

- Research-intensive, bottom-up fundamental stock selection in high-quality businesses

- Guided by First Manhattan’s fundamental investment principles honed over six decades

- Long-term investment horizon with low expected turnover

- Focused portfolio with a target of 25-30 U.S. publicly traded equities

- A business owner’s mindset and engagement with portfolio companies

This ETF is different from traditional ETFs – traditional ETFs tell the public what assets they hold each day; this ETF will not. This may create additional risks. For example, since this ETF provides less information to traders, they may charge you more money to trade this ETF’s shares. The price you pay to buy or sell ETF shares on an exchange may not match the value of the ETF’s portfolio. These risks may be even greater in bad or uncertain markets. See the ETF Prospectus for more information. For additional information regarding the distinctive attributes and risks of the ETF, see Risk and Additional Disclosures.

Overview

| Fund | FMCX |

|---|---|

| Key Information | 10/21/2024 |

| Inception Date | 04/22/2022 |

| Gross Expense Ratio | 0.70% |

| Net Assets | $102,224,020 |

| NAV | $31.75 |

| Style | Active |

| Asset Class | Equities |

| Benchmark | S&P 500 |

| Intraday NAV Ticker | FMCX.IV |

As of 03/31/2022

| Fund | FMCX |

|---|---|

| Trading Details | 10/21/2024 |

| Ticker | FMCX |

| CUSIP | 66538H211 |

| Primary Exchange | NYSE Arca |

| Shares Outstanding | 3,220,000 |

| Market Closing Price | $31.75 |

| Premium/Discount | 0.00% |

| 30-Day Median Bid Ask Spread | 0.38% |

Objective

FMCX favors long-term holdings in companies believed to:

- Possess durable competitive advantages

- Earn higher-than-average returns on capital

- Treat shareholders like partners

- Have opportunities to reinvest excess cash profits at attractive rates of return

| wdt_ID | Information | Data |

|---|---|---|

| 1 | Distributions | As of 09/30/2024 |

| 2 | 30-Day SEC Yield | 0.15% |

| 3 | Distribution Frequency | Quarterly |

Performance

Inception Date: 04/22/2022

Month-end as of

| Trailing Returns | NAV Returns | Market Returns |

|---|---|---|

| YTD | 17.84% | 17.79% |

| 1 Month | 3.23% | 3.23% |

| 3 Months | 9.26% | 9.17% |

| 6 Months | 8.42% | 8.26% |

| 1 Year | 32.38% | 32.22% |

| 3 Years (Annualized) | – | – |

| 5 Years (Annualized) | – | – |

| Since Inception (Annualized) | 10.79% | 10.80% |

| Since Inception (Cumulative) | 28.42% | 28.46% |

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns. Returns beyond 1 year are annualized.

| Trailing Returns | NAV Return | Market Return |

|---|---|---|

| YTD | 17.84% | 17.79% |

| 3 Months | 9.26% | 9.17% |

| 6 Months | 8.42% | 8.26% |

| 1 Year | 32.38% | 32.22% |

| 3 Years (Annualized) | – | – |

| 5 Years (Annualized) | – | – |

| Since Inception (Annualized) | 10.79% | 10.80% |

| Since Inception (Cumulative) | 28.42% | 28.46% |

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Investors may obtain performance data current to the most recent month-end by calling 888.530.2448.

Cumulative return is the aggregate amount that an investment has gained or lost over time. Annualized return is the average return gained or lost by an investment each year over a given time period.

NAV Return represents the closing price of underlying securities.

Market Return is calculated using the price which investors buy and sell ETF shares in the market.

Composition

As of 05/31/2024

| wdt_ID | Security | Security Identifier | Shares Held | Market Price | Market Value | Market Value % |

|---|---|---|---|---|---|---|

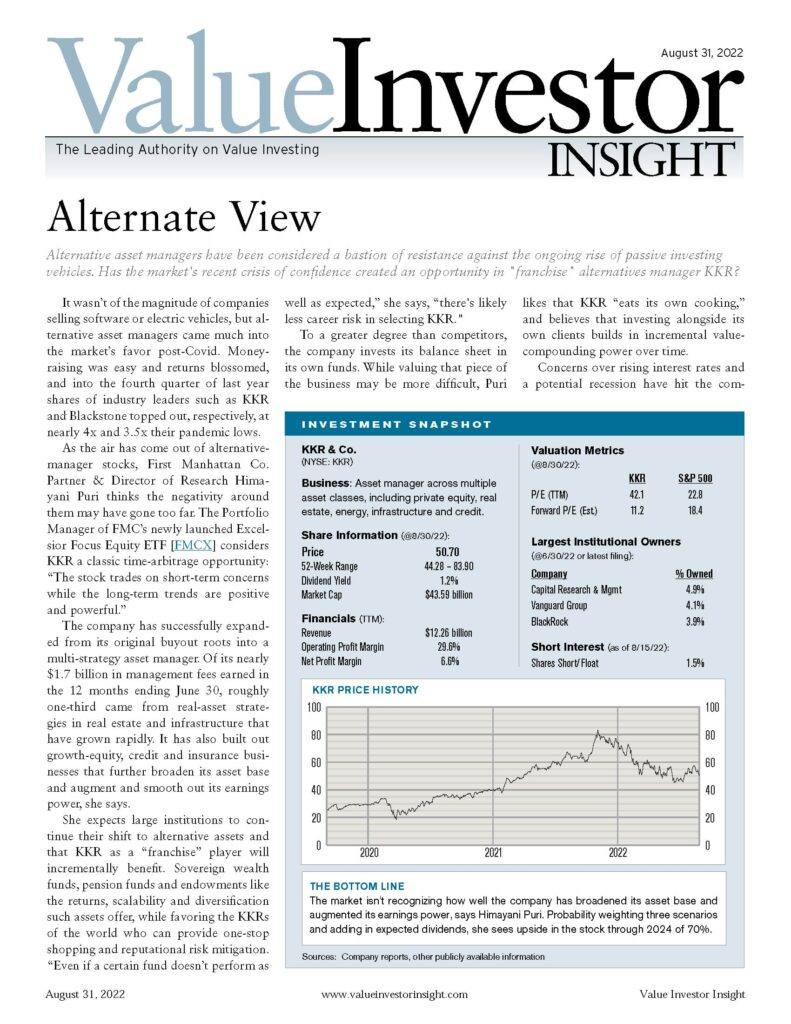

| 1 | KKR & Co Inc. | 7.87% | ||||

| 2 | Microsoft Corp. | 6.64% | ||||

| 3 | Berkshire Hathaway Inc Class A | 5.53% | ||||

| 4 | Aspen Technology Inc. | 4.98% | ||||

| 5 | Veralto Corp. | 4.79% | ||||

| 6 | Linde PLC | 4.75% | ||||

| 7 | Lowe's Companies, Inc. | 4.59% | ||||

| 8 | Take-Two Interactive Software, Inc. | 4.42% | ||||

| 9 | O'Reilly Automotive, Inc. | 3.37% | ||||

| 10 | Alphabet Inc. | 3.63% |

As a percent of total assets. The top ten holdings, industry sectors, and asset allocation are presented to illustrate examples of the securities that the Fund has bought and the diversity of areas in which the Fund may invest and may not be representative of the Fund’s current or future investments. The top ten holdings do not include money market instruments. Portfolio holdings are subject to change and should not be considered investment advice.

| wdt_ID | Empty Column | Information | Data |

|---|---|---|---|

| 2 | Sector 1 | X.XX% | |

| 3 | Sector 2 | X.XX% | |

| 4 | Sector 3 | X.XX% | |

| 5 | Sector 4 | X.XX% | |

| 6 | Sector 5 | X.XX% | |

| 7 | Sector 6 | X.XX% | |

| 8 | Sector 7 | X.XX% | |

| 9 | Sector 8 | X.XX% |

How to Buy

FMCX trades intraday on an exchange and is available through various channels, including broker-dealers, investment advisers, and other financial services firms.

Neither First Manhattan nor Northern Lights Distributor, LLC is affiliated with the firms listed. Their listing should not be viewed as a recommendation or endorsement.